Many QA Reader subscribers rely on our innovative data stream to identify, document, and report professional and general liability incidents to their Insurance carriers. Timely reporting of incidents to your insurance carrier is your obligation, and carriers can deny an incident or claim if it isn't reported in a timely basis.

Many QA Reader subscribers rely on our innovative data stream to identify, document, and report professional and general liability incidents to their Insurance carriers. Timely reporting of incidents to your insurance carrier is your obligation, and carriers can deny an incident or claim if it isn't reported in a timely basis.

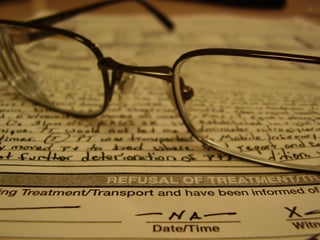

Liability Insurance Claims

Before I describe the process for identifying and reporting potentially compensable events to your insurance carrier, let's review the basics of your general and professional liability insurance policies (GL/PL). Normally when I start talking about insurance, people run from the room, so I’ll keep this short.

In order to improve your chances that a serious event will be covered by your insurance carrier, you need to make sure that you report the incident in a timely fashion. GL/PL insurance policies are issued one of two ways: “claims-made” or “occurrence.” Occurrence policies provide coverage for incidents that occur during the policy term, no matter when they're reported to your carrier.

Claims-made policies are different. Most long term care facilities are insured on the claims-made form. If your organization is insured on a claims-made policy form, it is your obligation to report to your insurance carrier all incidents that may likely lead to a professional or general liability claim. This requirement is a bit ambiguous, but that’s where QA reader comes in.

QA Reader allows you to systematize the incidents that may likely lead to a claim. In insurance speak, these are potentially compensable events (PCEs). In QA Reader, we call these PCEs “flagged events” or “serious events.” We recommend reporting all flagged events to your insurance agent or carrier on a monthly basis.

You can customize and report your flagged events one of two ways.

Report All Flagged Events

The first way of reporting events to your insurance carrier is by customizing the flagged events function in QA Reader and then reporting only flagged events to your insurance agent or insurance carrier.

You can customize the flagged event settings for your entire organization by simply clicking on the user icon in the upper right hand corner of your screen and choosing Account Settings. In your account settings, you'll see a listing of all of the incident types, injury types, outcomes and follow-up actions that can be selected to trigger a flagged event. The default settings may be enough.

Once you're satisfied with your flagged incident settings, you can go to the Incidents menu item on the left. In the Incidents view, choose a date range and select the check box “Serious.” Only the incidents that match the criteria that you set up will be displayed.

Finally, download the filtered incidents to Excel.

Create Custom Filters

A more flexible way of reporting events to your insurance agent or carrier is done by navigating directly to the Incidents menu item. In the Incidents view, filter the types of events or incidents you want to report.

First, select a date range that matches your insurance policy’s effective term (bounded by the policy retroactive date and expiration date). You do this by selecting a start and end date in the filter incidents section. QA Reader allows you to select one facility or a group of facilities, one or more incident types, injury types, actions taken, and subsequent treatments. You can select those incidents in which a record request has been received by a plaintiff attorney, or one that is reportable to the state.

Once you're satisfied with the parameters you've set, simply download the list to Excel and deliver it to your insurance agent.

QA Reader's flagged events feature makes liability claims much easier and takes the guesswork out of ambiguous requirements.

Next Steps

- Follow us on LinkedIn

- Get more great content - subscribe to our blog

- See QA Reader in action - request a live demo